GET FULLY IFRS 16 COMPLIANT

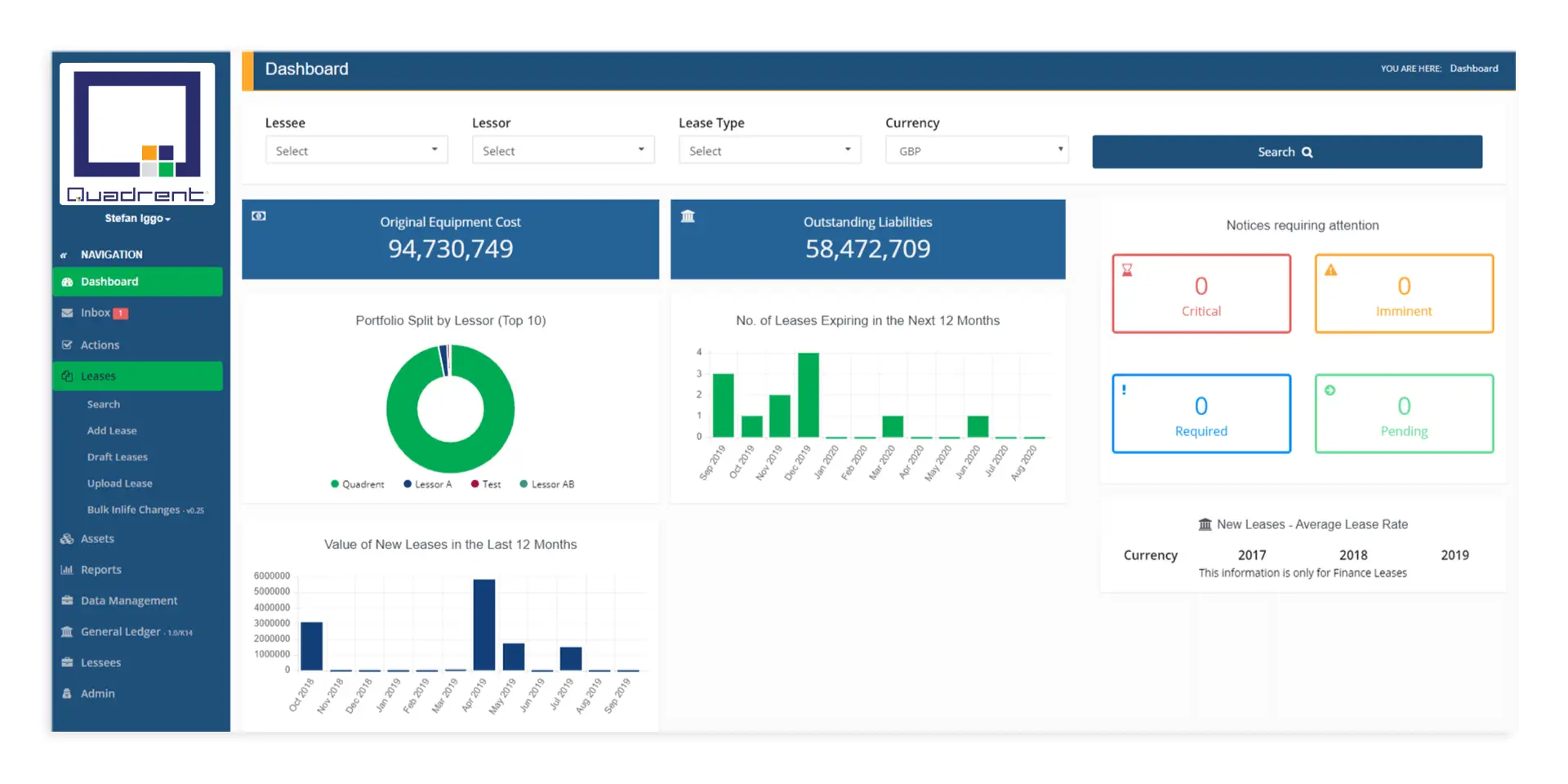

Quadrent’s Lease Optimisation Information System (LOIS) is a leading lease accounting software solution for IFRS 16 compliance and lease portfolio management. LOIS is a hassle-free SaaS solution that delivers all the tools and functionality needed to extract, validate and report on all your lease data.

.png)

Lease Portfolios Powered by

.png)

LOIS Features at a Glance

Instant IFRS 16 / AASB 16 compliance, including forecasting, modifications and journals.

All your leases in one portfolio utilising global analytics.

Easily customisable templates let you record exactly the data that is important to your business.

Forecast different scenarios using numerous accounting standards (IAS 17, IFRS 16, AASB 16 and FASB ASC 842) to see how metrics change.

Stand alone or full API enabled integration allowing you to run your lease portfolio with ease.

Amortisation and depreciation schedules and full audit trails provide full data integrity and traceability.

Flexible lease management system accounts for change at any detail.

Full access control catering to large and small teams and organisational structures.

Additional LOIS Features

Proactively manage your lease portfolio and confidently make strategic leasing decisions. These additional features can be added as extra to your standard LOIS subscription.

THE SANDPIT

A budgeting and forecasting tool designed to let you model and investigate the financial impact of future adjustments to your lease portfolio without impacting your live data.

DATA TRANSFORM APP

Automate the loading of large volumes of lease information for all new leases and modifications. Then automatically load your journals from LOIS directly back into your ERP.

LOW VALUE LEASES

Add your low-value leases to LOIS at a much lower cost per lease rate. Having all your lease information in one central place allows you to review the ROI of your entire lease portfolio. Individually, these may not be material, but when aggregated they could result in large savings if you are being overcharged or duplicating these leases.

MONTH-END PROCESS CONSULTING

Make significant time savings at these business-critical periods with a more streamlined IFRS 16 month-end process. Take advantage of our in-house CA qualified leasing accountants and let us review, analyse and feedback on your month-end process.

LEASE PORTFOLIO ANALYTICS

Using real-time data from 1.4 million data points, this allows you to analyse and control your entire portfolio through easily digestible and interactive dashboards, customised to the information you and all your stakeholders need to know.

Our Team Are Lease Accounting Experts Rather Than Software Developers

Our LOIS team are all CA qualified accountants. Therefore, Quadrent is the only company in the sector offering lease accounting expertise to support and provide advice for a lease accounting software solution. Coming from a foundation of accounting expertise rather than a stock standard SaaS rollout, LOIS is developed alongside our partner IRIS Innervision, and with years of leasing experience within the team, this is a product that truly understands leasing.

The partnership between IRIS Innervision and Quadrent has benefited some of the largest companies across Australia and New Zealand. These companies need strong automated and controlled accounting ledgers in an easy-to-use and efficient program.

Used by 300+ Customers Globally for IFRS 16 Compliance

Over 300 organisations around the globe use LOIS to generate complex calculations in order to produce income statements, cash flow and balance sheet impacts, to manage and enhance their lease portfolio.

With LOIS, you have the ability to load your own data and conduct scenario analysis in-house using the excel upload template configured to your master data requirements.

LOIS can manage all agreements and in life changes (modifications). Using the GL functionality LOIS creates a new amortisation schedule for the change as well as keeping the existing amortisation schedule for accurate reporting. All amendments are logged in a full audit trail.

Unlike Excel that requires a human element, LOIS can store and report on all asset data without the need for manual calculations and accounting. As a system, LOIS does the heavy-lifting for you. The system is fast to implement and automates processes, saving you time and money.

Who Is LOIS Suitable For?

Across APAC, LOIS has proven to be an effective lease accounting software solution for companies of all sizes from a range of industries.

The largest customer in the region has 7,000 leases stored in LOIS, while the smallest client has 33 leases. The largest asset leased in the region has a value of over AUD1 billion. In contrast, much smaller leases on the platform include those for technology hardware such as employee’s devices and point-of-sale systems. The average lease size due to the proliferation of property is circa $1.9m.

.png)